Melissa Dewalt caught the travel bug a decade ago when she drove from her home state of Pennsylvania across the country to California to visit her then-boyfriend. She then road-tripped north to Seattle.

Biden administration touts airline refund rules in renewed push for 'simpler customer service'

21.08.2024 - 13:27 / thepointsguy.com

Catapulting on efforts to eliminate travel and credit card fees, the Biden administration is cracking down on corporations' "unfair practices" that "add unnecessary headaches and hassles," the White House said recently.

Dubbed "Time is Money," the initiative includes various provisions the administration says will "save Americans time and money," including new rules governing airline refunds set to take effect in the coming months.

In a press release issued Aug. 10, the administration detailed two Consumer Financial Protection Bureau rules related to artificial intelligence, including one that would require companies make it possible to talk to a human customer service agent with the click of a button, thus helping consumers avoid customer service "doom loops." A second rule would identify when automated chatbots or AI voice recordings are unlawful, including when customers assume they're speaking with a human being.

According to an agency spokesperson, the CFPB only has jurisdiction over consumer financial products, so the rules would not regulate hotels or airlines. "The Consumer Financial Protection Bureau (CFPB) will initiate a rulemaking process that would require companies under its jurisdiction to let customers talk to a human by pressing a single button," the White House said in a fact sheet. According to the CFPB, companies under its jurisdiction would include banks like Chase, Citibank and Wells Fargo, which issue credit cards.

"The CFPB has been hearing for years about frustrations with customer service in banking – from getting trapped in phone tree doom loops to an inability to get past a bank chatbot," a CFPB spokesperson said via email. "The CFPB is looking at ways to make it easy and straightforward for consumers to get past a recording or AI and reach a human to resolve customer service issues with their financial institution."

Approximately 37% of Americans interacted with a bank's chatbot in 2022, according to CFPB data.

"Much of the industry uses simple rule-based chatbots with either decision tree logic or databases of keywords or emojis that trigger preset, limited responses or route customers to Frequently Asked Questions," the CFPB spokesperson said. "Other institutions have built their own chatbots by training algorithms with real customer conversations and chat logs. The banking industry has recently begun adopting advanced technologies, such as generative chatbots, to support customer service needs."

A third rule from the Federal Trade Commission would prohibit illicit review and endorsement practices such as using fake reviews, suppressing honest negative reviews and paying for positive reviews.

"This rule can have a big impact in the travel industry," a White House

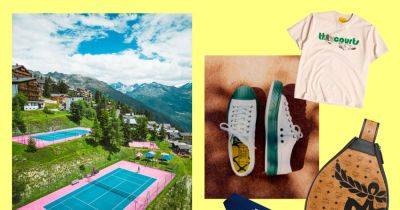

Attractions and Accessories for the Tennis Obsessed

Clarksville, a historic district of Austin, Texas, has lately emerged as a stylish dining and shopping enclave. Among the area’s most compelling new businesses is La Embajada, a design shop housed in a 1923 Craftsman bungalow. Combining the hospitality and interiors expertise of its founder, Raul Cabra — who has designed tableware for some of Mexico City’s most celebrated restaurants, including Rosetta and Pujol — La Embajada presents a refined, regionally diverse selection of Mexico’s artisanal offerings. A series of small rooms display vintage and contemporary furniture, from stately midcentury armchairs and 1970s glass sconces to a minimalist agave fiber rug by the Oaxaca-based textile artist Trine Ellitsgaard. The house is also an actual residence. Cabra often stays in the bedroom up the creaky stairs, and he’s recently made it available for short-term stays (bookings include a daily basket of baked goods from Austin’s Swedish Hill). Guests can purchase the room’s handmade décor, such as a pair of sleek bedside lamps in milky white onyx, a 1960s La Malinche dresser and a bedspread from a Michoacan manufacturer that once supplied Herman Miller. Downstairs, glassware, candles and gifts fill a section modeled after a typical general store in a small Mexican town. But La Embajada’s heart is its inviting kitchen, where visiting chefs cook elaborate meals and staff prepare ice cream and coffee. In another twist, every bespoke detail — including a hammered copper sink, caramel-colored tiles and waxed pine cabinets — can be custom-ordered for one’s own home.

United executive explains why the airline hasn't bought Boeing's newest widebody plane

Despite 481 orders from airlines around the world, Boeing can't sell US carriers on its new widebody jetliner.

United Airlines Flight Attendants Take Step Toward Strike

United Airlines flight attendants voted overwhelmingly to authorize a strike as tensions with management rise.

America's third-smallest state is home to the hottest airline turf battle

America's third-smallest state by land mass is suddenly at the center of the nation's latest airline turf war.

Score Discounted Flights to Argentina, Brazil, and More With American Airlines' Fare Sale

Saving on flights to South America just got easier with deals from American Airlines to some of the most popular destinations across the continent.

Frontier Airlines Unveils New Routes for Fall

Frontier Airlines unveiled 11 new routes across 15 airports that are scheduled to launch in October and November.

Does US Government Allowing Alaska-Hawaiian Airlines Merger Set a Bad Precedent?

Alaska Airlines cleared a major hurdle this week with the Department of Justice and its intended merger with Hawaiian Airlines. Getting regulatory approval from the DOJ is a huge step.

Aeromexico takes on American Airlines with new route from Miami to Cancun

The flag carrier of Mexico is growing in Miami with an all-new route to Cancun, Mexico.

I've been a student in the UK for 6 years. But my family in the US is getting older, and I'm torn about moving back to be with them.

This as-told-to essay is based on a conversation with Scarlett Kiaras-Attari, a marketing executive and education content creator who moved to the UK for her studies. It has been edited for length and clarity.

The 8 best destinations for an RV or camper van adventure

Aug 23, 2024 • 7 min read

Ukraine's military says it used US glide bombs for strikes in Russia's Kursk region

Ukraine's military says it used high-precision US glide bombs for strikes in Russia's Kursk region and that is has recaptured some territory in the eastern Ukrainian region of Kharkiv that has been under a Russian offensive since spring.